China's top leader, Xi Jinping, told officials at a Communist Party meeting on Sunday that the Covid-19 outbreak is a "big test" for the country, and policy adjustments would cushion the economy for a downturn. Xi acknowledged "obvious shortcomings in response to the epidemic," warning that short-term financial stress could be imminent.

We've noted on several occasions that China's economy is completely paralyzed.

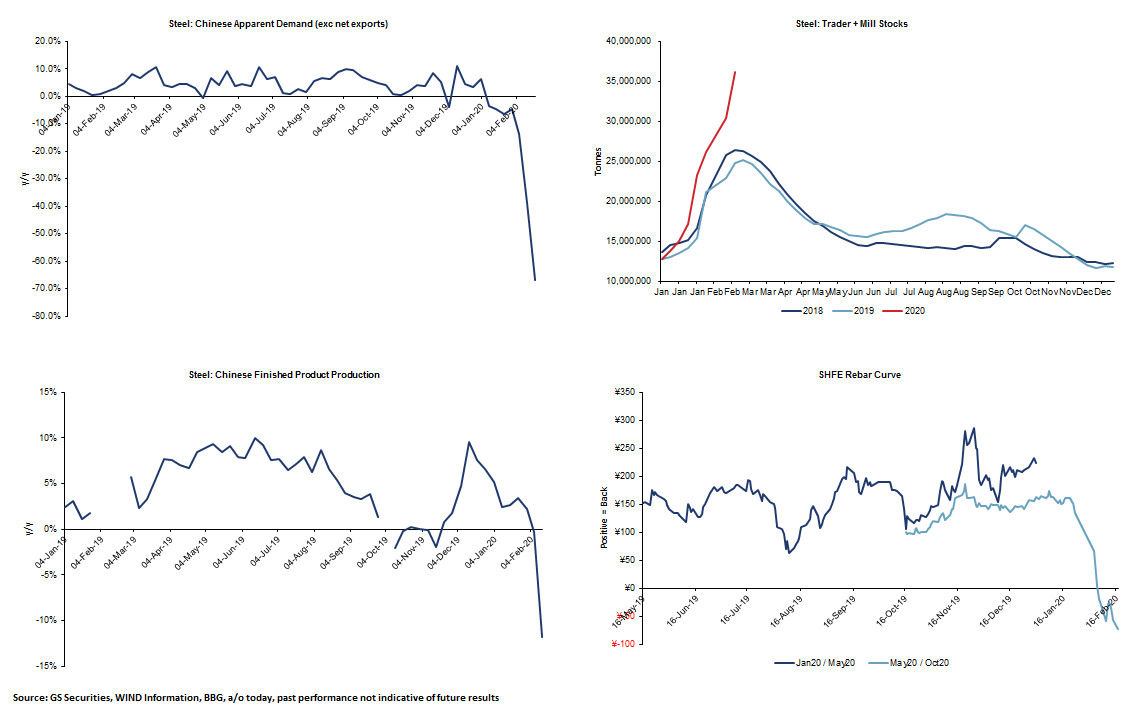

Just take a look at Goldman’s Adam Gillard's recent commodity report that suggests full country apparent demand is down a massive -66% y/y.

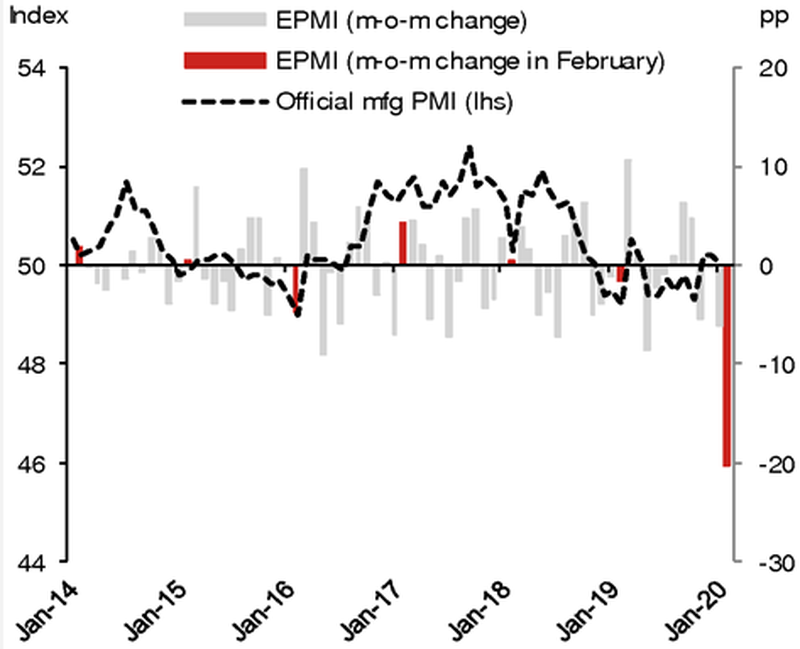

So, it's apparent that the closely followed China manufacturing PMI could print in 30-40 range this month, suggesting the current growth slump triggered by the virus is collapsing the Chinese economy.

Xi said Sunday the "the epidemic situation is still severe and complex, and prevention and control work is in the most difficult and critical stage."

He warned:

"The outbreak of novel coronavirus pneumonia will inevitably have a relatively big impact on the economy and society."Beijing has deployed several rounds of monetary policy to support the economy, as a twin shock (demand and supply) is having devastating impacts on first-quarter growth.

Xi said low-risk provinces should restart production monetarily, areas with medium-level risks should restart production on an orderly timeline, and high-risk regions should focus on virus containment strategies.

For more color on China's plunging economic output, we noted last week several "alternative" economic indicators such as real-time measurements of air pollution (a proxy for industrial output), daily coal consumption (a proxy for electricity usage and manufacturing) and traffic congestion levels (a proxy for commerce and mobility), concluding that China's economy appears to have ground to a halt.

These observations were subsequently reaffirmed when we showed that steel demand, property sales, and passenger traffic had all failed to rebound from the "dead zone" hit during China's Lunar New Year hibernation.

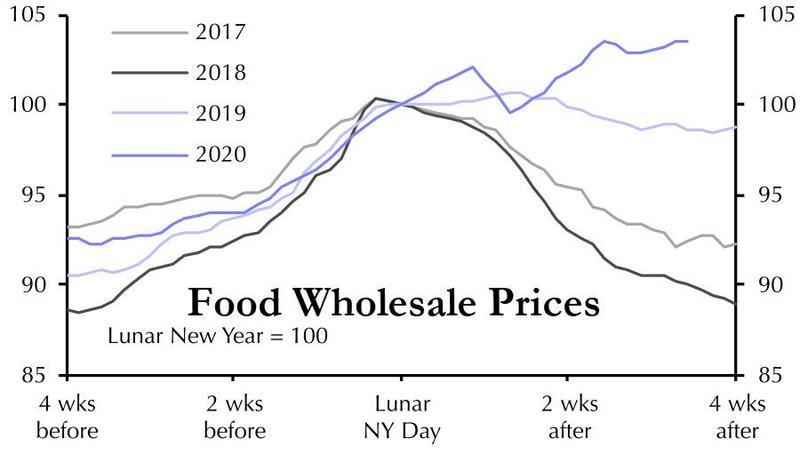

No matter the policy support Beijing deploys to stabilize the economy, economic paralysis is already visible, with 750 million people in lockdown, where people are becoming irritable at Beijing's now openly over propaganda to downplay the epidemic. The shuttering of factories will lead to countless workers being fired and companies running out of funds, as the next big bankruptcy wave will hit smaller to medium-sized operations. To make matters worse, the price of food is surging for the most volatile combination possible, a collapse of the economy mixed with social unrest, one which, if not arrested soon could lead a new violent phase in the virus outbreak.

Putting it all together, the most significant economic shock to hit China's economy since WW2 is unfolding, and it also tilt the global economy into recession.

source zh