“At the very minimum, Federal Reserve Notes to

the tune of

20,000 metric tons of gold were ‘circulating naked’ in 1933.”

20,000 metric tons of gold were ‘circulating naked’ in 1933.”

FDR’s 1933 Gold Confiscation was a

Bailout of the Federal Reserve Bank

by Daniel Carr, owner/operator of Moonlight Mint and www.DC-Coin.com

President

Franklin Delano Roosevelt’s 1933 executive order outlawing the private

ownership of gold in the United States was arguably unconstitutional. But why

did he do it ? Many historians and economists point to efforts to get the

economy moving again as the reason, the theory being that people were

hoarding gold and the velocity of money in circulation needed to be sped up.

But the

real reason for the gold confiscation was a bailout of the

privately-controlled Federal Reserve Bank. And the evidence has been printed

right in front of our faces.

PAPER REPLACES SPECIE

During

the 1800s, paper money was suspect in the eyes of many. Nobody would ever

choose a government-issue $20 note over a $20 gold coin. Gradually during the

late 1800s and early 1900s, confidence in government paper money increased to

the point where it was widely accepted. People accepted the money because

they felt confident they could exchange it at the US Treasury or any Federal

Reserve Bank for gold at any time – it even said so on the notes. Without the

gold exchange clauses printed directly on the notes, the public would have

been much less likely to accept them. Silver Certificates and United States

Notes circulated alongside Gold Certificates, which were legally interchangeable

dollar-for-dollar.

THE “FED” AND EASY MONEY

In 1913

the Federal Reserve Bank was established and it began issuing Federal Reserve

Notes the following year.

Once free

of the restrictions imposed by the limitations of available physical gold for

coinage, the quantity of Dollars in circulation increased dramatically. The

increase was mostly in the form of paper money, not specie.

The

result was an economic “boom”, also known as “The Roaring Twenties”

(1923-1929). But like all artificially-induced stimulus, it came to a crash

in the fall of 1929. The burden of over-extended credit was the culprit.

Prior to the formation of the Federal Reserve, money in circulation consisted

of copper, silver, and gold coins, United States Notes, Silver Certificates,

and Gold Certificates. All of these were non-interest-bearing, were issued

directly by the US Treasury, and did not have any debt associated with their

issuance.

Notes

issued by the Federal Reserve, however, were generally lent out, with

interest due. So for every Federal Reserve dollar in circulation, somebody

needed that dollar to pay off a debt. During the Roaring Twenties, a lot of

people took on debt, resulting in a great credit expansion. When only

physical gold and silver was used as money, institutions were very cautious

about lending it out because if the debtor defaulted, the creditor would be

out some serious (sound) money.

But with

the advent of Federal Reserve Notes, the bank was more willing to lend. And

with easier qualification terms, people stepped up to the window. The

increased willingness to lend was due to the fact that the item being lent

out was just a piece of replaceable paper, not a hard-to-get piece of gold.

Sure, the notes said “redeemable in gold” (otherwise they might have been

refused in commerce). But few members of the public actually exchanged such

notes for actual gold. And thus, the Federal Reserve was free to lend almost

at will, with little regard for loan losses. When the interest burden of all

that new credit began to weigh more-heavily on the general economy, the

inevitable credit contraction led to the Stock Market Crash and the Great

Depression. Everyone was suddenly reluctant to borrow, banks were reluctant

to lend, and the velocity of money in circulation slowed to a crawl.

A GOLD RUN ?

The financial

footing of the United States became shaky. European countries which were

holding substantial quantities of US gold-clause notes began presenting them

to exchange for physical gold. The US Government’s fixed price of gold at

$20.67 per troy ounce had been in effect for some time. But as the Great Depression

deepened, the free-market price of gold started creeping up above that. This

was an indication that confidence in gold-clause notes was starting to wane.

A gold run on the Federal Reserve bank was imminent. And that was something

that couldn’t be tolerated.

And the

reason that a gold run couldn’t be tolerated, is that neither the Federal

Reserve nor the US Treasury held anywhere near enough gold to back all the

Gold Certificates and Federal Reserve Notes that were in circulation. And

printing more of these notes would only erode confidence in them even

further. The gold fractional-reserve system was at the end of the road.

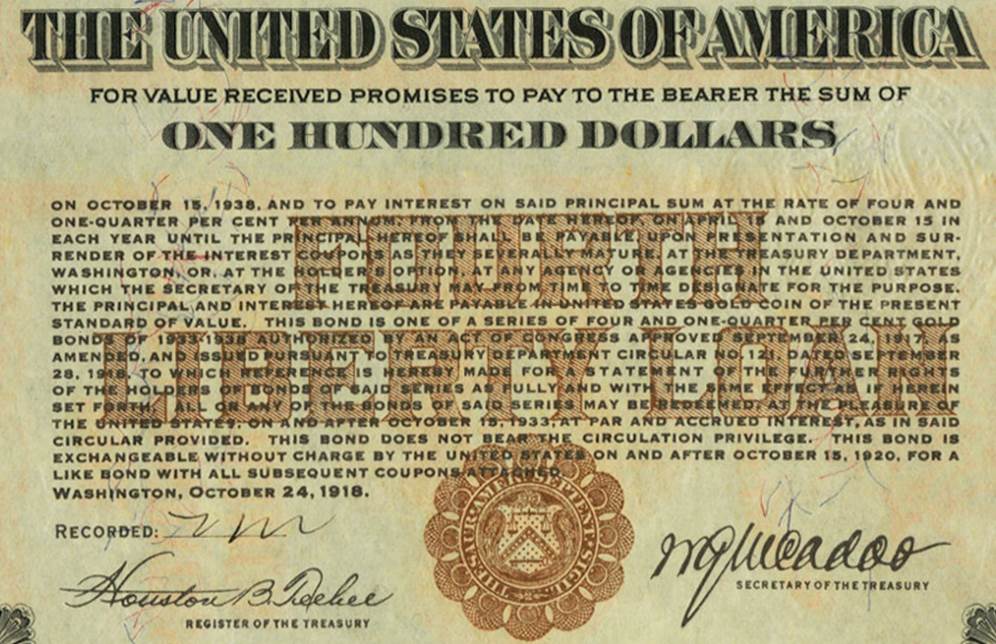

GOLD-CLAUSE NOTES

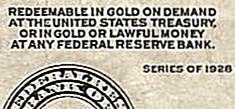

This is a

typical gold-exchange clause found on Gold Certificates issued by the US

Treasury from about 1905 to 1922.

And the

clause on series 1928 US Treasury Gold Certificates looked like this:

Series

1914 Federal Reserve Notes carried this gold-clause:

1928

series Federal Reserve Notes were printed with this:

HOW MANY IN CIRCULATION ?

Proof

that the Federal Reserve Bank and the US Treasury were in serious trouble,

that they didn’t have nearly enough gold to back the notes issued, can be

found in the tables in the appendix to this article.

The total

numbers of various notes issued are available from a number of sources. The

appendix shows data reported in two books: “The Standard Handbook of United

States Paper Money”, 6th edition (1977), by Chuck O’Donnell; and

“The Comprehensive Catalog of U.S. Paper Money”, 1981 edition, by Gene

Hessler.

To calculate

the total face value of all gold-clause notes in circulation, it is necessary

to know how many were issued, and how many may have still been around in

1933. The appendix tables do not include US Treasury Gold Certificates issued

prior to 1905. Quantities of pre-1905 Gold Certificates were relatively small,

and most would have been redeemed (and replaced with new notes) before 1933.

The number of notes issued is known. The number surviving in 1933 can only be

estimated.

According

to the US Treasury, the average life span of a current $100 bill in

circulation is about 7.5 years. Adjusted for inflation, one-hundred 2011

Dollars is equal to roughly five 1933 Dollars. Five Dollars in 1933 was a

fair amount of money. The velocity of money in circulation was much lower

then as well, especially during the Great Depression. A person receiving a $5

bill in change in 1933 would be unlikely to wad it up and casually stuff it

in their pocket. They would more likely carefully squirrel it away for some

other “rainy day”. So in 1933, a typical $5 bill would not get worn out as

fast as a 2011 $100 bill. And larger-denomination notes would circulate even

less often. Gold-clause notes would likely be the most tightly-held (and

least circulated) of all types of notes, followed by Silver Certificates and

US Notes (in that order). So it is probably a fair assumption that, on

average, the “half-life” of gold-clause notes in circulation would be at

least 20 years – meaning that after every 20 years or so, half the notes

remaining in circulation would have to be replaced due to being worn out. The

majority of gold-clause notes were issued shortly before 1933 during the

1928-1933 period, so they would still be in relatively new condition in 1933.

All this

doesn’t account for gold-clause notes that were turned in for physical gold,

even though they may have still been in good condition. But if Federal

Reserve Notes were turned in while still in good condition, the notes would

have simply been placed back into circulation by the Federal Reserve Bank or

US Treasury. Many US Treasury Gold Certificates turned in for redemption may

have actually been cancelled and not re-released into circulation.

GOLD SHORTFALL

Records

indicate that the total gold reserves of the country in 1933 were 4 Billion

dollars worth. And at $20.67 per troy ounce, that equates to about 6,000

metric tons of gold.

The total

face value of US Treasury Gold Certificates issued from 1905 to 1928 equates

to more than 16,000 metric tons of gold. Taking the generous assumption that

the US Treasury did not issue more Gold Certificates than they had gold to

back them, would mean that only 37.5% of all 1905-1928 Gold Certificates were

still outstanding in 1933. In other words, if 37.5% of all Gold Certificates

were still outstanding in 1933, the US Treasury would have just enough gold

to back them.

Now the

real problem is the gold-clause Federal Reserve Notes. Since these were

generally re-released upon redemption (if in good condition), the only

attrition in the quantity of notes outstanding would be due to replacement of

worn-out notes. A conservative estimate of the total number of Federal

Reserve Notes still in circulation in 1933 would be at least 75%.

The

total face value of gold-clause Federal Reserve Notes issued prior to 1933

was equivalent to nearly 54,000 metric tons of gold. If 75% of them were outstanding

in 1933, that would still be 40,500 metric tons of gold that the Federal

Reserve Bank (and the US Treasury) didn’t have. Even taking the extremely low

estimate of only 37.5% of the Federal Reserve Notes remaining, that would

still be over 20,000 metric tons of gold. With US gold reserves at 6,000

tons, this would be a shortfall of 14,000 tons. But those 6,000 tons were

needed to cover the US Treasury Gold Certificates. So at the very minimum,

Federal Reserve Notes to the tune of 20,000 metric tons of gold were

“circulating naked” in 1933.

THE BAILOUT

So

along

comes FDR. One of the very first things he did was issue an executive

order

basically outlawing the private ownership of gold bullion. US Treasury

Gold

Certificates were no longer legal tender when held by the general

public, unless

exchanged at the US Treasury or Federal Reserve Bank for other

non-gold paper.

The US Treasury could then transfer 6,000 metric tons of gold to the

Federal

Reserve as a token backing for the “full faith and credit of the

United States”. Reportedly, the US Treasury sent gold certificates to

the Federal Reserve

in exchange for Federal Reserve Notes. So the net result of this

exchange was

that the privately-controlled Federal Reserve Bank held US Treasury

Gold Certificates

backed by US Treasury gold, while the US Treasury held Federal Reserve

Notes

backed by “credit”. These actions bailed out the privately-controlled

Federal

Reserve bank, which as of 1933 would no longer be in danger of

collapsing due

to a sort-fall of 20,000 or more metric tons of gold.

During a

“Fireside Chat” on 07 May 1933, Roosevelt basically admitted that gold-clause

obligations far exceeded the amount of gold held by the US Treasury and

Federal Reserve. In fact, the total gold obligations far exceeded the amount

of gold in the entire world, not even counting corporate gold obligations.

“Behind government currency

we have, in addition to the promise to pay, a reserve of gold and a small

reserve of silver, neither of them anything like the total amount of the

currency.”

– FDR, 07 May 1933.

In

the same speech, Roosevelt outlined that the total US gold reserves amounted

to between 3 and 4 billion dollars worth (4,500-6,000 metric tons), and that

all the gold in all the world was valued at 11 billion dollars (16,500 metric

tons). At the same time, Roosevelt admits that US Government (and Federal

Reserve) gold obligations were at least 30 billion dollars worth (45,000

metric tons), and that private US corporations had promised another 60

billion dollars worth (90,000 metric tons).

Roosevelt’s

07 May 1933 Fireside Chat (the important part of the audio starts at

15:30). NOTE: I have searched the internet and all posted transcripts of

the speech are missing the key phrase “neither of them anything like the

total amount of the currency”. But that statement is clearly heard in the

audio.

As

citizens complied with the new ”law” by turning in gold, the gold reserves of

the US Treasury and Federal Reserve increased. After most of the

public’s gold was turned in, FDR raised the official price from $20.67 to

$35.00 per troy ounce. How “convenient”. Gold-clause Federal Reserve notes were

not recalled and remained in circulation. But they could no longer be exchanged

for gold, except by certain foreign central banks. Those with connections

were able to buy valuable assets with mere paper. Wealth was concentrated in

fewer hands.

The new

series of 1934 Federal Reserve notes no longer had any gold clause, they were

only redeemable for “lawful money”, whatever that was.

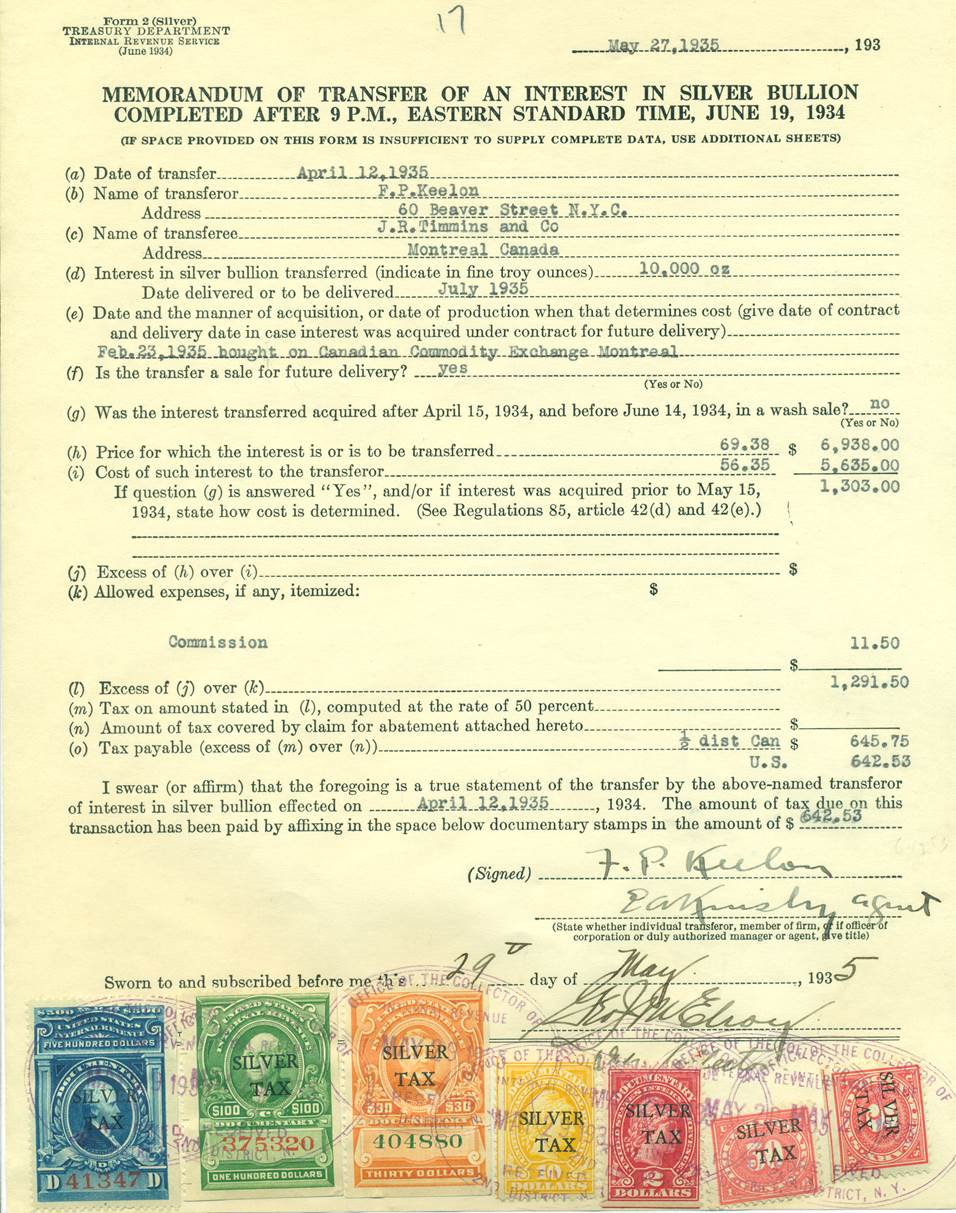

But

negating gold obligations and confiscating gold wasn’t enough. The people and

entities responsible for this fiasco were concerned that the public would

reject the new un-backed paper money and continue the bank runs by switching

to silver bullion. A silver confiscation and a recall of

currently-circulating silver coins was unworkable since it would be

disastrous for commerce. The solution was two-fold: end the minting of silver

dollars; and impose a “Silver Tax”. Any entity that made a profit on the

transfer of silver bullion, had to pay a full 50% of that profit as tax. The

Silver Tax Act was imposed in 1934, and lasted until 1963.

THE FALLOUT

The

Federal Reserve Bank’s actions, and FDR’s resulting bailout, set in motion

the ultimate debt-enslavement of the US Government and its citizens.

ANOTHER GOLD CONFISCATION ?

The credit

contraction which started in 2008 has many similarities to 1929. But this

time, there is no gold limitation constraining the printing presses. Some

people believe that another gold confiscation is a very real possibility. But

the major difference between now and 1933 is that in 1933 the Federal Reserve

owed a lot of gold that it didn’t have. Today the only backing for the US

Dollar is the “full faith and credit” of the United States. Government debts,

domestic and international, can now be paid with nothing more than

newly-printed paper. The liabilities of the Federal Reserve Bank are no

longer denominated in gold, and they haven’t been since Richard Nixon closed

the international dollar-gold exchange window in 1971.

APPENDIX

United States Gold Obligation

Gold Certificates and Federal Reserve Notes

Total Face Value of Notes Issued, 1907-1933

Table Columns:

Series: Year of enactment (issue).

District: Federal Reserve Bank District.

$FV: Face Value of note in Dollars.

Notes Issued: Total number of notes printed and

issued.

The Total Face Value is the sum of the

face values times the numbers of notes.

US TREASURY GOLD CERTIFICATES

Series $FV Notes Issued Total Face

Value

1907 10 105,094,800

1922 10 160,604,000

1905 20 4,676,000

1906 20 55,954,587

1922 20 87,120,000

1913 50 1,624,000

1922 50 5,984,000

1922 100 2,444,000

1907 1,000 228,000

1922 1,000 80,000

1928 10 130,812,000

20 66,204,000

50 5,520,000

100 3,240,000

500 420,000

1,000 288,000

5,000 24,000

10,000 36,000

$

10,754,999,740.00

Official US price 1933: $20.67 (per troy oz)

Total gold obligation: 0.52 Billion troy oz.

Total gold obligation: 16,183 Metric Tons

FEDERAL RESERVE NOTES

Series/District $FV Notes Issued Total Face

Value

1914 A 5 90,400,000

B 5 297,852,000

C 5 103,824,000

D 5 73,216,000

E 5 45,932,000

F 5 54,476,000

G 5 164,876,000

H 5 41,704,000

I 5 29,280,000

J 5 43,928,000

K 5 28,536,000

L 5 91,848,000

1914 A 10 69,756,000

B 10 176,728,000

C 10 56,616,000

D 10 43,856,000

E 10 27,528,000

F 10 31,400,000

G 10 84,804,000

H 10 21,508,000

I 10 14,376,000

J 10 16,448,000

K 10 12,988,000

L 10 41,432,000

1914 A 20 25,760,000

B 20 58,704,000

C 20 30,088,000

D 20 38,544,000

E 20 16,944,000

F 20 15,956,000

G 20 46,776,000

H 20 10,748,000

I 20 6,600,000

J 20 9,172,000

K 20 6,872,000

L 20 35,756,000

1914 A 50 1,052,000

B 50 5,264,000

C 50 3,720,000

D 50 6,012,000

E 50 1,664,000

F 50 868,000

G 50 3,988,000

H 50 572,000

I 50 160,000

J 50 372,000

K 50 216,000

L 50 1,365,000

1914 A 100 728,000

B 100 3,084,000

C 100 636,000

D 100 668,000

E 100 416,000

F 100 476,000

G 100 888,000

H 100 188,000

I 100 120,000

J 100 256,000

K 100 124,000

L 100 1,064,000

1918 A 500 17,600

B 500 125,600

C 500 24,000

D 500 15,600

E 500 23,200

F 500 34,400

G 500 38,000

H 500 14,400

I 500 7,200

J 500 16,000

K 500 6,000

L 500 24,000

1918 A 1,000 39,600

B 1,000 124,800

C 1,000 16,400

D 1,000 8,800

E 1,000 17,600

F 1,000 43,200

G 1,000 23,600

H 1,000 8,400

I 1,000 7,600

J 1,000 15,200

K 1,000 6,000

L 1,000 22,400

1918 A 5,000 800

B 5,000 1,600

C 5,000 0

D 5,000 400

E 5,000 400

F 5,000 8

G 5,000 800

H 5,000 400

I 5,000 0

J 5,000 0

K 5,000 0

L 5,000 2,800

1918 A 10,000 800

B 10,000 1,600

C 10,000 0

D 10,000 400

E 10,000 400

F 10,000 0

G 10,000 0

H 10,000 400

I 10,000 0

J 10,000 0

K 10,000 0

L 10,000 2,000

1928 A 5 8,025,300

B 5 14,701,884

C 5 11,819,712

D 5 9,049,500

E 5 6,027,600

F 5 10,964,400

G 5 12,326,052

H 5 4,675,200

I 5 4,284,300

J 5 4,480,800

K 5 8,137,824

L 5 9,792,000

1928-A A 5 9,404,252

B 5 42,878,196

C 5 10,806,012

D 5 6,822,000

E 5 2,409,900

F 5 3,537,600

G 5 37,882,176

H 5 2,731,824

I 5 652,800

J 5 3,572,400

K 5 2,564,400

L 5 6,565,500

1928-B A 5 28,430,724

B 5 51,157,536

C 5 25,698,396

D 5 24,874,272

E 5 15,151,932

F 5 13,386,420

G 5 17,157,036

H 5 20,251,716

I 5 6,954,060

J 5 10,677,636

K 5 4,334,400

L 5 28,840,080

1928-C D 5 3,293,640

F 5 2,056,200

L 5 266,304

1928-D F 5 1,281,600

1928 A 10 9,804,552

B 10 11,295,796

C 10 8,114,412

D 10 7,570,680

E 10 4,534,800

F 10 6,807,720

G 10 8,130,000

H 10 4,124,100

I 10 3,874,440

J 10 3,620,400

K 10 4,855,500

L 10 7,086,900

1928-A A 10 2,893,440

B 10 16,631,056

C 10 2,710,680

D 10 5,610,000

E 10 552,300

F 10 3,033,480

G 10 8,715,000

H 10 531,600

I 10 102,600

J 10 410,400

K 10 961,800

L 10 2,547,900

1928-B A 10 33,218,088

B 10 44,458,308

C 10 22,689,216

D 10 17,418,024

E 10 12,714,504

F 10 5,246,700

G 10 38,035,000

H 10 10,814,664

I 10 5,294,460

J 10 7,748,040

K 10 3,396,096

L 10 22,695,300

1928-C B 10 2,902,678

D 10 4,230,428

E 10 304,800

F 10 688,380

G 10 2,423,400

1928 A 20 3,790,880

B 20 12,797,200

C 20 3,787,200

D 20 10,626,900

E 20 4,119,600

F 20 3,842,388

G 20 10,891,740

H 20 2,523,300

I 20 2,633,100

J 20 2,584,500

K 20 1,568,500

L 20 8,404,800

1928-A A 20 1,293,900

B 20 1,055,800

C 20 1,717,200

D 20 625,200

E 20 1,534,500

F 20 1,442,400

G 20 822,000

H 20 573,300

I 20 0

J 20 113,900

K 20 1,032,000

L 20 0

1928-B A 20 7,749,636

B 20 19,448,436

C 20 8,095,548

D 20 11,684,196

E 20 4,413,900

F 20 2,390,240

G 20 17,220,276

H 20 3,834,600

I 20 3,298,920

J 20 4,941,252

K 20 2,406,060

L 20 9,689,124

1928-C G 20 3,363,300

L 20 1,420,200

1928 A 50 265,200

B 50 1,351,800

C 50 997,056

D 50 1,161,900

E 50 539,400

F 50 538,800

G 50 1,348,620

H 50 627,300

I 50 106,200

J 50 252,600

K 50 109,920

L 50 447,600

1928-A A 50 1,834,989

B 50 3,392,328

C 50 3,078,944

D 50 2,453,364

E 50 1,516,500

F 50 338,400

G 50 5,263,956

H 50 880,500

I 50 780,240

J 50 791,604

K 50 701,496

L 50 1,522,620

1928 A 100 376,000

B 100 755,400

C 100 389,100

D 100 542,400

E 100 364,416

F 100 357,000

G 100 783,300

H 100 187,200

I 100 102,000

J 100 234,612

K 100 80,140

L 100 486,000

1928-A A 100 980,400

B 100 2,938,176

C 100 1,496,844

D 100 992,436

E 100 621,364

F 100 371,400

G 100 4,010,424

H 100 749,544

I 100 503,040

J 100 681,804

K 100 594,456

L 100 1,228,032

1928 A 500 69,120

B 500 299,400

C 500 135,120

D 500 166,440

E 500 84,720

F 500 69,360

G 500 573,600

H 500 66,180

I 500 34,680

J 500 510,720

K 500 70,560

L 500 64,080

1928 A 1,000 58,320

B 1,000 139,200

C 1,000 96,708

D 1,000 79,680

E 1,000 66,840

F 1,000 47,400

G 1,000 355,800

H 1,000 60,000

I 1,000 26,640

J 1,000 62,172

K 1,000 42,960

L 1,000 67,920

1928 A 5,000 1,320

B 5,000 2,640

C 5,000 0

D 5,000 3,000

E 5,000 3,984

F 5,000 1,440

G 5,000 3,480

H 5,000 0

I 5,000 0

J 5,000 720

K 5,000 360

L 5,000 51,300

1928 A 10,000 1,320

B 10,000 4,680

C 10,000 0

D 10,000 960

E 10,000 3,024

F 10,000 1,440

G 10,000 1,800

H 10,000 480

I 10,000 480

J 10,000 480

K 10,000 360

L 10,000 1,824

$

35,833,509,910.00

Official US price 1933: $20.67 (per troy oz)

Total gold obligation: 1.7336 Billion troy oz.

Total gold obligation: 53,919 Metric Tons