August sales volume slows down dramatically

August tends to be a good sales month for California. Home buyers and sellers can make big changes as the kids are still out of school. Once the fall and winter hit, home buying and selling tends to enter a seasonally slow pattern. Yet the drop from July was rather strong. Home sales volume dropped by 13 percent.

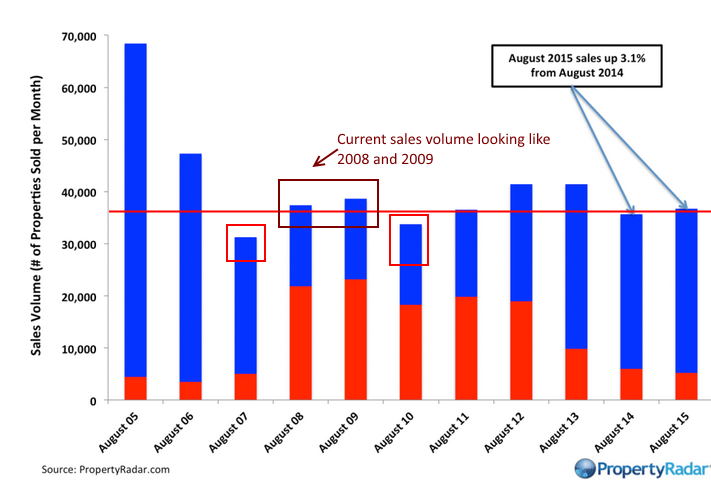

Take a look at August sales volume:

The worst year for sales volume in California came in 2007. When did home prices hit a peak in California? 2007. Sales volume is a leading indicator. And the reason for this slow down is coming from a few sources:

-Big money pulling away from California

-Current prices are out of reach for many families

-Inventory growing as buyer lust ebbs

-Stock market slowdown impacting trend

-Double-digit gains become single-digit gains which become…?

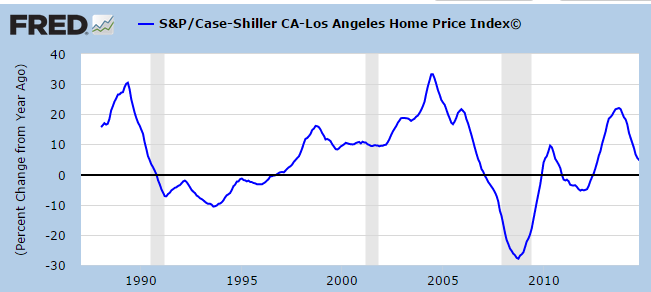

You can see this slow turning of the tide by looking at the Case Shiller data:

You see the crash followed, followed by a minor uptrend, followed by the 2009 and 2010 slowdown. You then see the recent boom and you can draw your conclusion as to where the trend is heading. People argue that housing is driven by emotion and this perspective was being espoused by those justifying higher prices despite weak income growth. I agree with this but emotions are feeble things. As year-over-year gains look weak and it is very likely we will see a negative year-over-year price change soon, the perception will change quickly. Once this hits you enter another multi-year trend. The housing market is now a speculative segment of the economy just like oil futures or bonds. Naïve people choose to drink the Kool-Aid of survivorship bias and forget the 7,000,000+ people that lost their homes to foreclosure (with 1,000,000 here in California). You can absolutely make money in housing but to make it appear as a safe bet is foolish and goes against recent history.

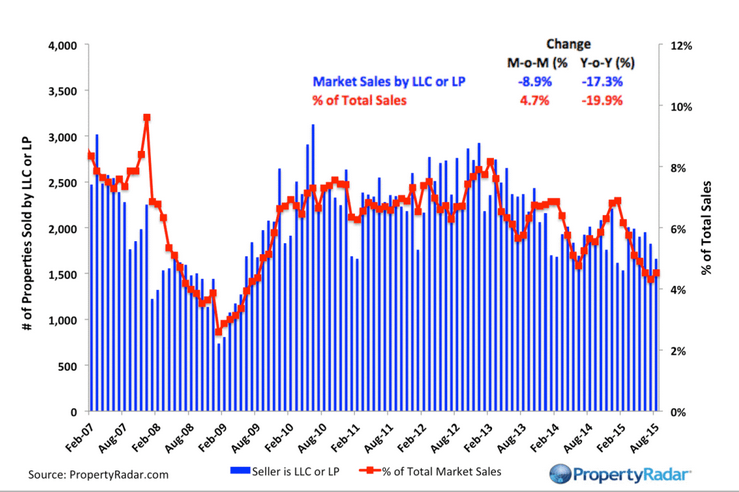

Big money is seeing limited deals in California and is pulling money out:

Sales to big investors are down 17 percent year-over-year. They made their money and are now enjoying the fruits of rental Armageddon. This is the result of the bailouts: a big drop in the homeownership rate while low rates transferred properties to those least needing it with low rates. Now rents are being increased even though incomes are stagnant. And you wonder why this political season is so extreme and the mainstream press is largely being overshadowed by outsider candidates. Populism is all the rage it would seem and California is seeing a growing number of renter households. Los Angeles is a renting majority county.

There seems to be little reason to rush out and buy at this point as sales volume falls, prices drop, and inventory is increasing right before the fall and winter season. The tide turns very slowly in real estate but when it does, the momentum tends to last.

http://www.doctorhousingbubble.com/california-sales-volume-2015-prices-rents-money-trends-real-estate/