Deposits

at Bank of Ireland are soon to face charges in the form of negative

interest rates after it emerged on Friday that the bank is set to become

the first Irish bank to charge customers for placing their cash on

deposit with the bank. Yet another Central Bank of yet another country decides to help crash the economy and force savers into the dangerous waters of the stock market, which itself is about to crash to levels of historical firsts.

|

| No way out, except in Gold and Silver |

This

radical move was expected as the European Central Bank began charging

large corporates and financial institutions 0.4% in March for depositing

cash with them overnight.

Bank

of Ireland is set to charge large companies for their deposits from

October. The bank said it is to charge companies for company deposits

worth over €10 million.

The

bank was not clear regarding what the new negative interest rate will

be but it is believed that a negative interest rate of 0.1 per cent will

initially be charged to such deposits by Ireland’s biggest bank.

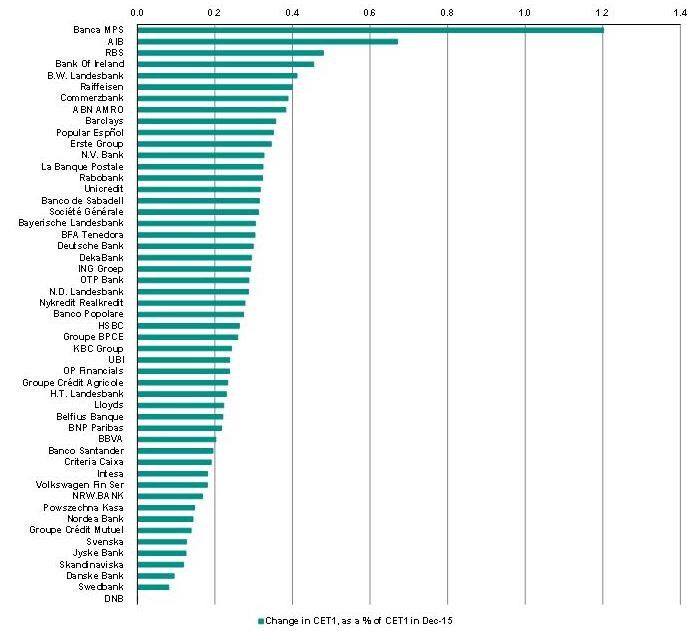

BOI recently failed the EU stress tests and

is seen as one of the most vulnerable banks in the EU - along

with Banca Monte dei Paschi di Siena (MPS), AIB and Ulster Bank's parent

RBS. All the banks clients, retail, SME and corporates are unsecured

creditors of the bank and exposed to the new bail-in regime.

|

| The robber baron list |

Only

larger customers will be affected by the charge for now. The bank

claims that it has no plans to levy a negative interest rate on either

personal or SME customers but negative interest rates seem likely as

long as the ECB continues with zero percent and negative interest rates.

Indeed, they are already being seen in Germany where retail clients are

being charged 0.4% to hold their cash in certain banks such

as Raiffeisenbank Gmund am Tegernsee.

The news came days after it emerged that FBD, one of Ireland’s largest insurance companies, have been moving cash out of Irish bank deposits and

into bonds. Fiona Muldoon, the FBD CEO cited extremely low returns on

deposits and bail-ins as the reason they were withdrawing cash from

Irish banks and diversifying into corporate and sovereign bonds. Muldoon

said as reported by the Irish Independent that

“As they mature, and as the bank bail-in rules come into play, it’s no longer the case that for corporate investors depositing at a bank is risk free,” she added.

“To be honest, the return is abysmal now. We’ve gone back to a more typical investment portfolio for an insurance company.”

“You have to be paid for the risk you take,” she added. “You might entertain the bail-in risk if you were being properly paid. But if you’ve a bank trying to charge you for leaving your money with them, you’re not inclined to take any risk at all.”

The

monetary policies being pursued by the ECB and other central banks is

making deposits, banks and the banking system vulnerable. Central bank

policies are contributing to individuals and companies withdrawing

deposits from banks which is making already fragile banks even more

fragile.

It

is important to note that while there are "deposit guarantees" in place

in most jurisdictions in the EU, these guarantees are only as good as

the solvency of the nation providing them. Many nations in the EU remain

insolvent or at least border line insolvent. Thus, the deposit

guarantee level of €100,000 in many EU states and £75,000 in the UK is

likely to be arbitrarily reduced to lower levels in the event of deposit

"haircuts" in the next banking and financial crisis.

Prudent

retail, SME and corporate clients are realizing the increasing risks

facing their deposits. They can no longer afford to simply leave their

deposits in a single bank account or indeed even in a few bank accounts.

Diversification into other assets, including an allocation to physical

gold, is becoming an important way to hedge the risks posed by negative

interest rates and bail-ins.

http://www.zerohedge.com/news/2016-08-22/irelands-biggest-bank-charging-depositors-negative-interest-rate-madness